Closing the books also locks in the prior period transactions so people can’t change those balances without proper authorization. After you’ve transferred your income and expenses into the Income Summary account, you’ll close that account, moving the balance to Retained Earnings, which is a permanent account. We collaborate with business-to-business vendors, connecting them with potential buyers.

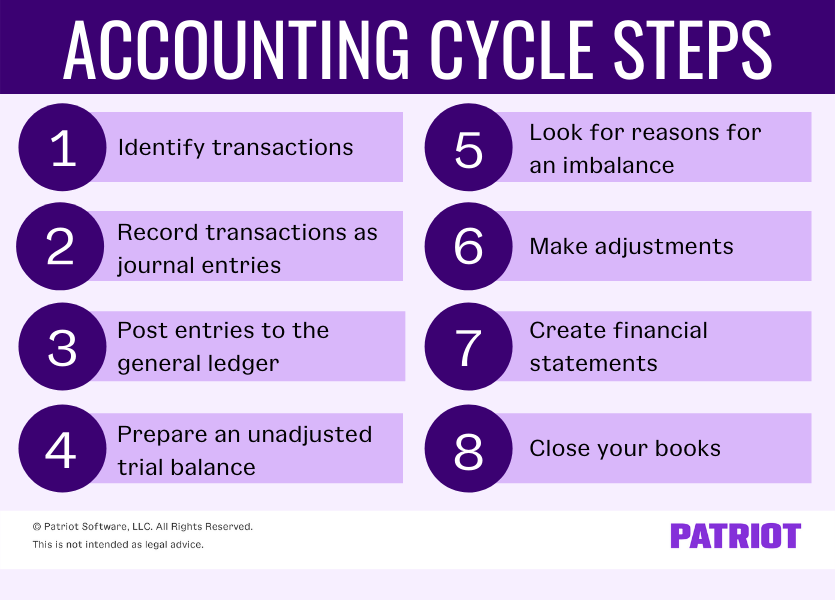

Steps of the accounting cycle

However, today these steps are occurring with electronic speed and accuracy within sophisticated yet inexpensive accounting software. The accountant can enter adjusting entries into the software and can instantaneously obtain a complete set of financial statements by simply selecting them from a menu. After reviewing the financial statements, the accountant is able to make additional adjustments and almost immediately obtain the revised reports. The software will also prepare, record, and post the closing entries. It will also reverse adjusting entries that have been designated to be reversed.

Step 6: Prepare financial statements

- He’s a co-founder of Best Writing, an all-in-one platform connecting writers with businesses.

- The next step of the accounting cycle is to organize the various accounts by preparing two important financial statements, namely, the income statement and the balance sheet.

- Some disadvantages are that the information may be biased, can be estimated to a degree, can be manipulated, and that the units used to measure business performance, namely cash, change in value.

- The income statement lists all expenses incurred as well as all revenues collected by the entity during its financial period.

- Since temporary accounts are already closed at this point, the post-closing trial balance contains real accounts only.

- It does not provide complete assurance that the accounting records are correct and accurate.

Now, let’s have a closer look on the complete accounting cycle process by performing the following example step by step. The operating cycle can be expressed in a formula as the sum of the financial analysis ratios for days’ sales outstanding and the average collection period. Understanding the operating cycle in your business is essential for cash flow management. The accounting cycle is important because it gives companies a set of well-planned steps to organize the bookkeeping process to avoid falling into the pitfalls of poor accounting practices. Before you create your financial statements, you need to make adjustments to account for any corrections for accruals or deferrals.

The 8 Steps of the Accounting Cycle

It lets you track your business’s finances and understand how much cash you have available. The first step in the accounting cycle is to identify your business’s transactions, such as vendor payments, sales, and purchases. It’s helpful to also note some other details to make it easier to categorize transactions. The result of posting adjusting entries should be an adjusted trial balance where the total credit balance and the total debit balance match.

Post Adjusting Journal Entries to General Ledger

Companies may opt for monthly, quarterly, or annual financial analyses based on their specific needs. Business transactions are usually recorded using the double-entry bookkeeping system. They are recorded in journal entries under at least two accounts (at least one debited and at least one credited). At the end of the accounting period, a trial balance is calculated as the fourth step in the accounting cycle. A trial balance shows the company its unadjusted balances in each account.

Identify and analyze transactions during the accounting period.

Ray’s accounting system creates journal entries for his bank and credit card transactions automatically. An example of identifying transactions would start with point-of-sale software. Many of these software options automatically identify a transaction. deleting invoices and bills in xero part 2 Accounting is made up of all of the ways that a business’s money moves. It documents every transaction, making sure that things are accurate and kept track of. Without accounting, most businesses would be in poor financial health.

Now it’s time to record the above transaction in the general Journal. To gain a better understanding of this, consider an error in the general ledger. This entry needs to reference where the error exists so that anyone reviewing it can verify it for accuracy.

With double-entry accounting, common in business-to-business transactions, each transaction has a debit and a credit equal to each other. It gives a report of balances but does not require multiple entries. During the accounting cycle, many transactions occur and are recorded.

You need to perform these bookkeeping tasks throughout the entire fiscal year. Closing entries offset all of the balances in your revenue and expense accounts. You offset the balances using something called “retained earnings.” Essentially, this is the profit or loss for the year that is “retained” in your business.

If a transaction is identified but it isn’t recorded, then it’s like it never happened at all. An example of an adjustment is a salary or bill paid later in the accounting period. Because it was recorded as accounts payable when the cost originally occurred, it requires an adjustment to remove the charge. Bookkeepers or accountants are often responsible for recording these transactions during the accounting cycle.

This step occurs in the second half of the accounting cycle after the period ends and you’ve already identified, recorded, and posted your transactions. The first step of the accounting cycle is to analyze each transaction as it occurs in the business. This step involves determining the titles and nature of accounts that the transaction will affect. Each business transaction must be properly analyzed so that it can be correctly recorded in the journal.